Exonhit to Acquire Redpath Integrated Pathology, Inc.

Complementary fit between RedPath’s DNA platform and ExonHit’s RNA platform

ExonHit Therapeutics S.A. announced that it entered into a binding agreement for the acquisition of RedPath Integrated pathology, Inc., a privately held molecular diagnostics company, focused on cancer. RedPath will become part of ExonHit’s US operations.

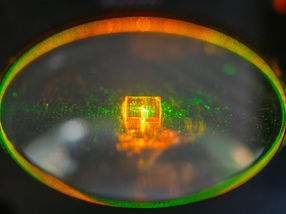

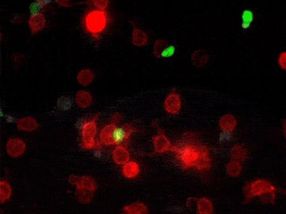

Headquartered in Pittsburgh, Pennsylvania, RedPath has a unique DNA-based technology platform, PathFinderTG®, which provides diagnostic information that can lead to a more personalized patient clinical management decision. This analytical tool improves the diagnosis of difficult cases in which cancerous or pre-cancerous conditions are not identified by a conventional pathology examination.

RedPath successfully developed, launched, and earned reimbursement for the PathFinderTG® molecular diagnostic assay for pancreatic cancer. A second assay to differentiate primary from metastasis tumors is being launched. The company’s other service lines include two programs in late-stage development and several earlier stage development programs in oncology.

“The acquisition of RedPath is a significant milestone in ExonHit’s strategy to become an internationally recognized player in molecular diagnostics. This transaction will strengthen our presence in the USA which represents 55% of the multi-billion dollar molecular diagnostics market,” said Loïc Maurel, M.D., President of the Management Board at ExonHit Therapeutics. “RedPath provides a strong strategic and business fit with ExonHit. We are looking forward to working with the talented RedPath team and believe that this strategic move will give ExonHit a new dimension, with an innovative offering in oncology, the fastest-growing segment in molecular diagnostics.”

The addition of RedPath’s DNA platform to ExonHit’s RNA-based platform is a synergistic addition that directly links the significant role DNA mutations play in altering the regulation of alternative splicing. It is currently estimated that greater than 10% of all described human gene mutations directly impact splicing. The combined approach will allow for the possibility of more accurate diagnostic tests with a strengthened IP position.

Under the terms of the combination agreement, ExonHit Therapeutics will pay an upfront of USD 12.5 million in cash and USD 10 million in stock. Starting in 2012, RedPath’s current shareholders may receive subsequent additional payments of up to USD 9.5 million dependent on the achievement of specific sales targets. The transaction, which is subject to approval by ExonHit’s shareholders at an upcoming Extraordinary General Meeting to be convened, is expected to close before mid-July 2010.

Most read news

Topics

Organizations

Other news from the department business & finance

Get the analytics and lab tech industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.