Frost & Sullivan: Diagnostic and Therapeutic Potential of microRNAs Stimulate Need for More Research Tools

Product innovation and the development of high-qualitative assays are the need of the hour

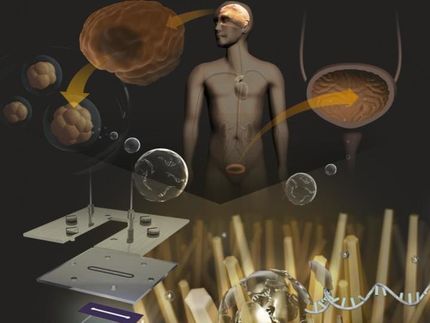

Rapid growth in microRNA (miRNA) research over the past two years, owing to its diagnostic and therapeutic potential, has fuelled development in the global miRNA tools and services market. Of the various miRNA technologies, which include quantitative real-time polymerase chain reaction (qRT PCR), microarrays and functional tools, qRT PCR remains the fastest-growing, while microarray is gradually being replaced by next-generation sequencing platforms.

New analysis from Frost & Sullivan, Global Analysis of MicroRNA Tools and Services Market, finds that the tools side of the market earned revenues of $110.0 million in 2012 and estimates this to more than double to reach $247.7 million in 2017. The US contributed to about 47% of the revenue followed by 36.7% from Europe, while leaving the rest to APAC and ROW. The miRNA services market earned revenues of $35.1 million in 2012 and this is expected to grow to $63.3 million in 2017. The end users covered are academic and research institutes, core facilities, and pharmaceutical and biotech companies.

The growth of therapeutic and diagnostic enterprises, higher research funding and increased outsourcing to contract research organisations in the U.S. will present immense opportunities for the miRNA tools and services market. At the same time, sequestration measures in the country will slow down market expansion. In Asia-Pacific, increased investments by foreign companies in emerging nations such as Japan, China and India will encourage local mergers and acquisitions and propel the market forward.

“As miRNA research evolves globally and more efficient products are required, the space is burgeoning with technology innovations,” said Frost & Sullivan Healthcare Senior Research Analyst Divyaa Ravishankar. “Strategic alliances for product development are taking place, resulting in novel kits for qPCR and new mimics and inhibitors that help researchers shorten their project timeline and get more funding.”

With more research laboratories entering the market and demand for commercial assays growing, researchers often look to obtain miRNA tools through routes other than commercial miRNA microarray vendors. For instance, researchers can produce in-house miRNA microarrays or their own miRNA knockdown and up-regulation tools. This is a major underlying limitation to the market, which is also challenged by potential pricing pressures.

Nevertheless, the impact of these restraints will decline as miRNA functional analysis matures and vendors enhance tools. Eventually, commoditisation will lead to a drop in costs and nullify any cost and quality benefits of in-house production.

“To sustain product value until then, market participants must continue to offer technology improvements and differentiated features, and strategically compete without making deep pricing cuts that may irreversibly damage market potential,” suggested Ravishankar. “Providing complete workflow solutions and discounts when a customer purchases products along with several different portfolios will simplify purchasing and attract new customers.”

Most read news

Other news from the department business & finance

Get the analytics and lab tech industry in your inbox

From now on, don't miss a thing: Our newsletter for analytics and lab technology brings you up to date every Tuesday. The latest industry news, product highlights and innovations - compact and easy to understand in your inbox. Researched by us so you don't have to.