Monoclonal antibody sales to almost double in coming years

In 2007 total global monoclonal antibody (mAb) sales reached $26 billion and are forecast to almost double to $49 billion by 2013. While small molecule drug sales will continue to make up the majority of total market sales, the mAb market, with a compound annual growth rate (CAGR) of almost 11% will continue to grow at a much greater rate than their small molecule counterparts. Traditionally, the ‘big five’ mAbs – Avastin, Herceptin, Rituxan, Humira and Remicade – have dominated the market, cornering almost 80% of sales in 2007. However, independent market analyst Datamonitor has identified an ‘emerging eight’ group of mAbs that will each achieve annual sales of at least $500 million between 2007-2013.

Segmenting the prescription pharmaceutical market by molecule type – small molecule, therapeutic protein, monoclonal antibody and vaccine – reveals different outlooks for the segments, with a particularly stark difference in forecast growth rates between small molecules and monoclonal antibodies. The small molecule segment will continue to account for the majority of total market sales, but is growing at a slower rate. In contrast, the monoclonal antibody segment will still account for a modest share of total market sales in 2013, but will grow at an impressive CAGR of 10.9% from 2007–13.

The primary reason for the difference between small molecule and monoclonal antibody growth outlooks is the degree of exposure to generic competition. Small molecules are the focus of the voracious generics industry while monoclonal antibodies are expected to remain effectively insulated from generic competition in 2013 due to an insurmountable blend of regulatory, technical and intellectual property barriers.

However, the superior growth outlook of monoclonal antibodies is not just due to the absence of generic competition, says Datamonitor pharmaceutical markets analyst John Bird. “mAbs currently – and will continue to do so in 2013 – command a three-fold average revenue per product premium over small molecules.

“This mAb revenue premium is supported by a higher demand for mAbs because they address therapy areas of high unmet need and lower competitive intensity due to accessing a novel target space,” he says.

Big 5 dominance set to remain

Historically within the total mAb market, it’s been the ‘big five’ that have generated the vast majority of sales growth, and this trend is forecast to continue. Remarkably, these five mAbs – Genentech/Roche’s colorectal, breast and non-small cell lung cancer treatment Avastin (bevacizumab) and the HER2+ breast cancer treatment Herceptin (trastuzumab), Biogen Idec/Genentech/Roche’s Non-Hodgkin’s lymphoma and rheumatoid arthritis treatment Rituxan (rituximab) and the anti-inflammatory mAbs; (primarily treating rheumatoid arthritis) Abbott’s Humira (adalimumab) and Johnson & Johnson/Schering Plough/Mitsubishi Tanabe’s Remicade (infliximab) – each have/are forecast to have annual sales greater than $3 billion from 2007-2013.

In 2007 total company reported sales figures for these five key therapies made up 77% of the total mAb segment. The ‘big five’ has also shaped the historical performance of the mAb market, with combined sales growth of these mAbs contributing to 78% of the impressive total historical mAb market absolute sales growth of $22bn, Mr. Bird says. “The same five mAbs are expected to retain their market leadership with a combined 60% market share in 2013.”

The ‘big five’ all share common characteristics which provides some insight into their success. They are all first-to-market mAbs addressing novel targets (with the exception of second-to-market Humira), and all address disease areas with high unmet need. The sheer size of the sales for these five products can be further accounted for by their successful ‘land grab’ of a novel target; starting in a commercial environment with close to 100% market share followed by aggressive horizontal expansion across multiple indications, thus rapidly increasing their potential market size.

‘Emerging 8’ will add extra sales impetus

While the bulk of the mAb segment growth is expected to come from the ‘big five’, Datamonitor has identified eight emerging therapies that are each forecast to demonstrate significant increases in annual sales – to greater than $500m – between 2007 and 2013. There are eight products outside of the ‘big five’ forecast to achieve such growth – Elan/Wyeth’s bapineuzumab, Amgen and Eisai’s denosumab, AstraZeneca/Abbott’s Numax (motavizumab), Johnson & Johnson/Schering Plough’s golimumab, Genentech/Novartis’s Lucentis (ranibizumab), Roche/Chugai’s Actemra (tocilizumab), Biogen Idec/Elan’s Tysabri (natalizumab) and UCB’s Cimzia (certolizumab pegol).

Together, the ‘emerging eight’ will generate a combined increase in annual sales of approximately $11 billion between 2007 and 2013, which represents a larger injection of growth to the mAb segment than from the ‘big five’ incumbents.

Small molecule threat looms…

One of the key competitive advantages of mAbs to date has been their ability to modulate protein targets that no other molecule type can reach, most notably small molecules. However, those mAbs that bind target proteins that possess a cytoplasmic tyrosine kinase domain will face a potential threat from small molecule agents targeting this domain. From the perspective of mAbs targeting receptor/ligand pairings which contain members of the receptor tyrosine kinase superfamily (Avastin, Herceptin, Erbitux etc), tyrosine kinase domains present a weak point, or a ‘way in’ for direct small molecule competitors, Mr. Bird says.

“In contrast, those mAbs that bind target receptor/ligand pairings devoid of small molecule-suited hydrophobic pockets (Rituxan/CD20, denosumab/RANKL, bapineuzumab/Amyloid beta) look set to remain insulated from any direct small molecule competitive threat,” he says.

See the theme worlds for related content

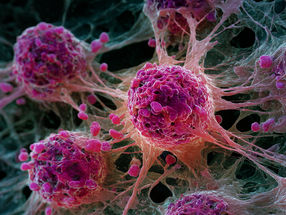

Topic world Antibodies

Antibodies are specialized molecules of our immune system that can specifically recognize and neutralize pathogens or foreign substances. Antibody research in biotech and pharma has recognized this natural defense potential and is working intensively to make it therapeutically useful. From monoclonal antibodies used against cancer or autoimmune diseases to antibody-drug conjugates that specifically transport drugs to disease cells - the possibilities are enormous

Topic world Antibodies

Antibodies are specialized molecules of our immune system that can specifically recognize and neutralize pathogens or foreign substances. Antibody research in biotech and pharma has recognized this natural defense potential and is working intensively to make it therapeutically useful. From monoclonal antibodies used against cancer or autoimmune diseases to antibody-drug conjugates that specifically transport drugs to disease cells - the possibilities are enormous