Growth for Vacuum Pumps is in High-Tech Applications, According to Frost & Sullivan

The European market will expand from €405.2 million in 2010 to €750.1 million in 2017

The European vacuum pumps market is anticipated to witness growth, fuelled by high-tech applications for vacuum technologies and the rising awareness of the benefits of using vacuum systems.

New analysis from Frost & Sullivan, Strategic Analysis of the European Vacuum Pumps Market, finds that the market earned revenues of €405.2 million in 2010 and estimates this to reach €750.1 million in 2017. The following application areas are covered in this research: process industry, semiconductor, coating technology, solar, analytics and R&D.

“The semiconductor industry, although affected by the economic crisis, remains the largest segment for vacuum pumps and accounted for just over 20% of the market in 2010,” notes Frost & Sullivan Research Associate Rajita Sahitya. “While its share is likely to decrease over the long-term, there will continue to be rising demand from high-tech sectors such as LED.”

There is also an increasing need for high vacuum quality and energy efficiency to reduce operational costs. Industry is moving towards efficient pumps to meet commercial and legislative requirements to preserve the environment. Suppliers will therefore benefit from the increased sale of energy-efficient vacuum pumps in the long term.

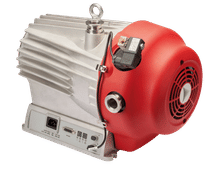

“Such trends will drive the adoption of dry vacuum pumps, with government policies and regulations on safety and health concerns also encouraging their use across Europe,” says Rajita. “These pumps are known to offer high quality and reliability and incur low maintenance costs.”

In addition, as an increasing number of end users become aware of the benefits of using dry vacuum pumps in their applications, the market is expected to expand as a result of new sales. The demand for clean and dry vacuum is supporting the increased use of dry vacuum pumps; a growing number of manufacturers are investing in more efficient dry vacuum pump designs as they strive to minimise any risk of oil contamination in end users’ processes and/or products.

On the other hand, a number of end-user industries have started to move their manufacturing facilities outside Europe, to countries such as China and India, where there are less strict environmental regulations and flexible regulatory requirements. These regulations support lower overheads, enabling companies to price their products competitively. As a result, the overall growth potential of the European market has been impacted, which presents a challenge to all market participants.

“Promisingly, however, Central and Eastern Europe is expected to be a growth pocket,” remarks Rajita. “Manufacturing bases in the chemical processing and water and effluent treatment sectors are shifting to the region, and offer good potential for market growth.”

Most read news

Other news from the department business & finance

These products might interest you

VARIO select by VACUUBRAND

Pumping Units for Chemical Processes and Precise Vacuum

Speed Controlled Chemistry Diaphragm Pumps + Interactive Vacuum Controller with Flexible User Management

HiPace® 80 Neo by Pfeiffer Vacuum

The Most Reliable Hybrid Bearing Turbopump with Laser Balancing Technology

Compact yet powerful turbopumps with pumping speeds of up to 67 l/s for N2

HiScroll by Pfeiffer Vacuum

The extremely quiet, efficient, oil-free vacuum pumps of the HiScroll series

Covers many applications in the field of analytics, industry or research & development

VACUU·PURE® 10C by VACUUBRAND

Chemically Resistant and Oil-Free Vacuum down to 10 -3 Mbar

Advancement of screw pump technology for clean processes and pure products

SmartVane by Pfeiffer Vacuum

First Rotary Vane Pump for Mass Spectrometry with a Hermetically Sealed Pump Housing

Combines the advantages of the proven rotary vane pump principle with a revolutionary sealed design

Get the analytics and lab tech industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.